Money doesn't grow on fees

Whether you're investing for tomorrow or saving for today, Prosper lets you maximise your potential wealth at low to zero cost under one trusted app. Capital at risk.

Whether you're investing for tomorrow or saving for today, Prosper lets you maximise your potential wealth at low to zero cost under one trusted app. Capital at risk.

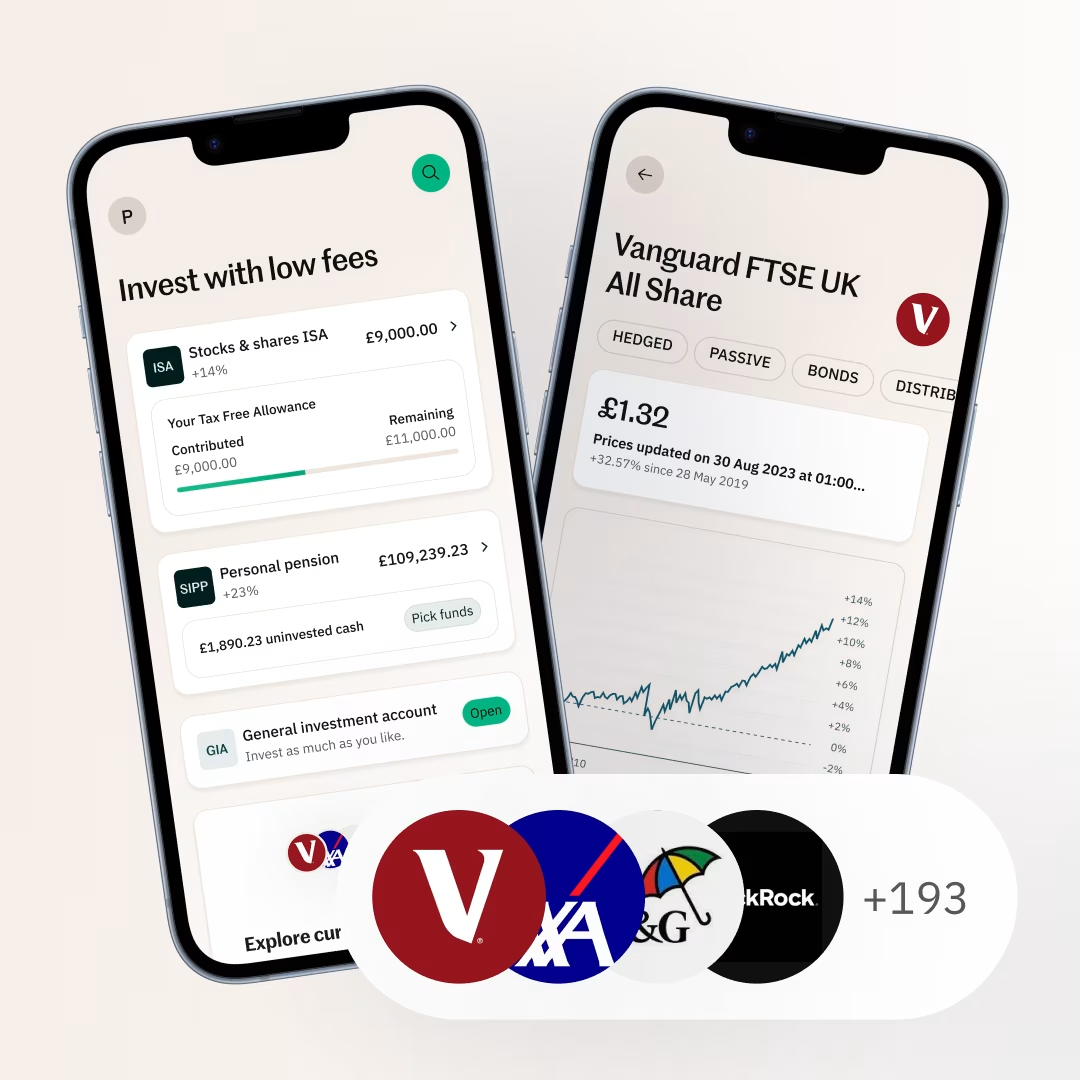

Take control of your financial future with access to 200+ funds with low to zero fees. This includes refunded fund fees on 30+ ETFs from the likes of BlackRock, Vanguard, and Fidelity.

Invest through your personal pension, ISA, and/or General Investment Account (GIA) with hassle-free transfers.

Capital at risk. Uninvested cash doesn't earn interest.

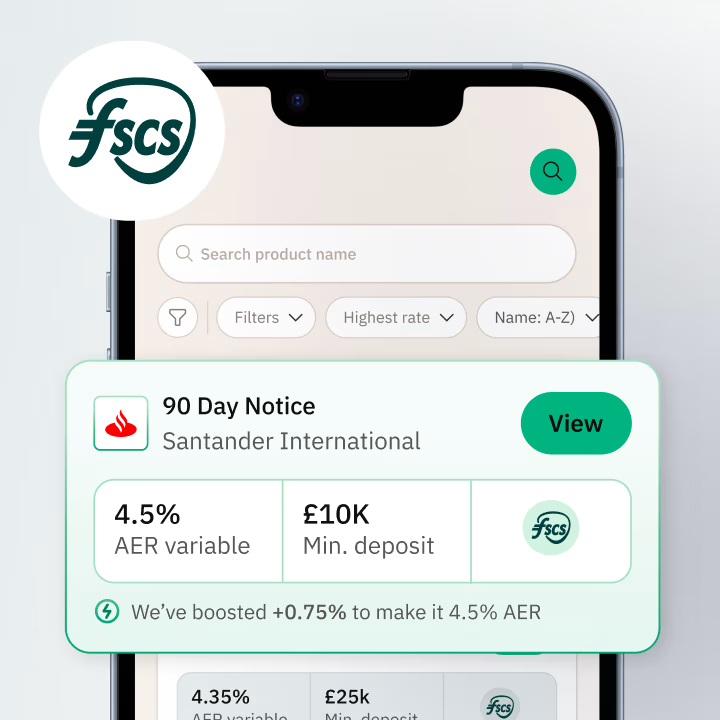

Unlock 50+ market-leading savings products — fixed-term, notice, and easy access — from trusted UK banks in one single app.

Get the best available rates with FSCS protection and move your money effortlesstly between products as your needs change.

Example rates shown are for illustrative purposes only and may vary.

Capital at risk.

Prosper uses SECCL as the custodian to hold your investment assets which is regulated by the FCA and wholly owned by Octopus Group

Prosper is authorised and regulated by the Financial Conduct Authority under registration number 991710

The banks we use for your cash savings products are part of the Financial Services Compensation Scheme

As featured in

We believe fees shouldn't eat into your returns. That's why we use scalable tech and industry relationships to offer cost-effective investment, savings, and pension products.

We retain interest on cash left uninvested in investment products and any cash held in your Prosper Wallet. We also may receive a share of the interest paid by the bank on each savings product, but the rate you see is the rate you get.

Here's how Prosper stacks up against other providers. See what you're really paying.

£0 annual platform fee

On any portfolio size.

30+ ETFs with refunded fund fees

From the likes of BlackRock, Vanguard, and Fidelity. Low, varying charges on other funds.

Cash marketplace with 50+ products

Market-beating rates from trusted UK banks with FSCS protection.

Access to private markets

Only available to professional investors.

Pay-as-you-go financial guidance

First session FREE, then £200 per hour (VAT excluded).

No interest paid on uninvested cash

Or cash held in the Prosper Wallet.

£625 annual platform fee

On a £250,000 investment (0.25%). Reduced rates for higher balances.

Varying annual ongoing charges

Charges ranging from 0.31% to 0.50% for different funds.

Cash Savings Hub

No access to private markets

No access to financial guidance

Interest paid on uninvested cash

But they retain a portion.

£1,125 annual platform fee

On a £250,000 investment.(0.45%). Reduced rates for higher balances.

Varying annual ongoing charges

Average 0.81% annual ongoing charge across the range of funds.

Access to multiple products from banking partners

No access to private markets

No access to financial guidance

Interest paid on uninvested cash

But they retain a portion.

£240 annual platform fee

On a £250,000 investment.(0.45%). Reduced rates for higher balances.

Varying annual ongoing charges

Charges ranging from 0.10% to 1.00%+ for different funds.

Access to Flagstone's cash deposit platform

No access to private markets

No access to financial guidance

Interest paid on uninvested cash

But they retain a portion.

£1,137 annual platform fee

On a £250,000 investment (0.45% + £12 subscription).

Varying annual ongoing charges

Charges ranging from 0.17% to 0.25%+ for different funds.

No savings marketplace

No access to private markets

Moneybox Aurora not yet available on all accounts

Interest paid on uninvested cash

But they retain a portion.

Sources: Prosper, AJ Bell, Hargreaves Lansdown, interactive investor, Moneybox, Unbiased.

Consolidate your pensions into one low-cost, transparent Self-Invested Personal Pension (SIPP).

Invest in 200+ funds and ETFs with no platform fees. We’ll help you transfer your ISA, hassle-free.

Maxed your tax-free allowances? Enjoy flexible, unlimited investing with a GIA. Capital gains tax and dividend tax is payable.

Access 50+ FSCS-protected savings products — fixed-rate, notice, and easy access — from UK trusted banks with market-beating rates.

ISA and SIPP eligibility and tax rules apply. Tax relief depends on personal circumstances and current rules can change.

We currently don’t offer annuity or support drawdowns at Prosper, or for individuals who have already made withdrawals from a pension, but we’re working on it.

Before transferring your pension, make sure to check for exit fees, lost benefits, employer contributions and compare charges. Transfers can be beneficial, but there’s no guarantee you’ll be better off.

When you invest your capital is at risk.

We are the only business we know that refunds the fees on over 30 funds from the best known asset managers around the world.

We bring you a curated selection of sectors, categories, geographies and currencies to create the portfolio to match your needs and interests.

Investments can go down as well as up.

"Like Monzo, Prosper is a customer champion brand shaking up the wealth industry. It’s only the beginning but I’m excited to help more people prosper!"